The dream of owning and operating a profitable online casino brand is more accessible today than ever, thanks to the emergence of robust and comprehensive White Label Solutions. For the ambitious entrepreneur, these platforms represent a ‘business-in-a-box’—a pre-built, licensed, and fully integrated iGaming environment ready for branding and marketing. Yet, affordability is relative, and the true investment goes far beyond the initial quote. To succeed, a potential operator must perform a rigorous cost analysis of the full lifecycle of a white label arrangement. This detailed breakdown will explore the three core pillars of white label casino pricing, the hidden expenditures, and the crucial financial considerations that underpin this lucrative business model.

The Three Pillars of White Label Casino Pricing

White label providers generally structure their pricing around three fundamental components: a one-time setup fee, an ongoing recurring monthly fee, and a revenue-sharing agreement. Understanding the interplay between these three is the foundation of a sound financial plan.

1. The Initial Setup Fee (The Barrier to Entry)

The setup fee is the upfront cost to establish your brand on the provider’s platform. This is the entry ticket, covering the technical and initial legal heavy lifting performed by the provider.

Typical Range: $5,000 to over $75,000 (USD)

What it Typically Covers:

- Platform License: The right to use the provider’s core software, including the Player Account Management (PAM) system, payment ledger, and back-office tools.

- Initial Integration: The connection of the platform to the provider’s existing library of aggregated games (slots, table games, live casino, etc.) and pre-integrated payment gateways.

- Branding & Customization: Basic application of your brand assets—logo, colour scheme, domain setup, and potentially a choice from a selection of pre-designed templates.

- Licensing Coverage: Crucially, this fee often covers the right to operate under the provider’s existing master gambling license (e.g., Curacao, Isle of Man), saving the operator hundreds of thousands of dollars and months of delay in obtaining one independently.

A lower setup fee often signals a higher long-term commitment via the revenue share, while a higher initial fee can sometimes be negotiated for a lower percentage cut of the gross gaming revenue (GGR) later on.

2. The Ongoing Monthly Fixed Fee (The Operational Overhead)

Some providers charge a fixed monthly fee that operates as a retainer for continuous services. This fee ensures the platform remains operational, secure, and up-to-date.

Typical Range: $1,000 to $5,000 per month (USD)

What it Typically Covers:

- Hosting and Server Maintenance: Continuous, high-availability server infrastructure.

- Technical Support: Access to the provider’s technical team for bug fixes and system stability.

- Software Updates: Regular updates to the PAM system, compliance features, and security patches.

- Basic Compliance: Ongoing management of the technical aspects of the master license.

This fee introduces predictability to the business model, regardless of how well the casino is performing. For a struggling startup, this fixed cost can be a heavy burden, but for a high-performing operation, it’s a small price for managed complexity.

3. The Revenue Share (The Long-Term Partnership)

This is the most impactful and least avoidable cost in the white label equation. The revenue share is a percentage of your Gross Gaming Revenue (GGR)—the total player bets minus player winnings—that is paid directly to the provider.

Typical Range: 10% to 40% of GGR.

Why the Range is Wide:

- Game Provider Fees: A significant portion of this share (often 10% to 16%) is specifically to cover the licensing fees for the dozens of third-party game studios (NetEnt, Evolution, Pragmatic Play, etc.) whose content you host. This is non-negotiable across the industry.

- Platform Fee: The remainder is the provider’s charge for their technology, licensing umbrella, and back-office services.

- Setup Fee Trade-off: As noted, a lower setup fee almost always corresponds to a higher revenue share percentage. This allows startups to minimize initial capital expenditure but increases the cost of profitability over time.

The revenue share transforms the provider from a mere vendor into a long-term partner whose success is directly tied to yours. However, operators must diligently forecast their GGR to determine their break-even point and the long-term impact on profitability.

Beyond the Platform: The True Cost of Launch

Any successful online casino operator will tell you that the platform costs are only the beginning. The most significant financial drain for a new venture is almost always marketing. A cost analysis must account for these crucial operational and regulatory expenses.

1. Marketing and Player Acquisition (The Engine of Growth)

The platform is only a store; marketing is what drives traffic. This category often requires the largest initial and ongoing investment.

- Affiliate Marketing: This is the bedrock of iGaming, requiring investment in affiliate management software and payouts to partners (CPA/Revenue Share models).

- Paid Advertising: Search engine marketing (PPC) and display ads.

- SEO & Content: Ongoing investment in content writers and SEO experts to improve organic visibility.

Initial Marketing Budget Estimate: $30,000 to $100,000 to establish a market presence.

2. Regulatory and Operational Reserves

White label providers often include the operating license, but the operator is still responsible for financial requirements related to player funds and regulatory compliance.

- Rolling Reserves: Many providers require a minimum cash reserve to be held (e.g., up to 25% of player balances) to cover large wins or potential chargebacks, tying up significant capital.

- Legal & Compliance: While the provider handles the technical compliance of the software, the operator needs a legal advisor to navigate jurisdictional marketing restrictions and local data protection laws.

3. Staffing and Day-to-Day Operations

Even with a white label, key staff are non-negotiable for the successful execution of the business model.

- Management: A CEO/Founder to drive strategy.

- Marketing/Affiliate Manager: To execute campaigns and manage partners.

- Customer Support: While some white label providers offer a support team, many successful brands handle Tier 1 support themselves to maintain brand quality and control.

White Label Solutions: A Cost-Benefit Conclusion

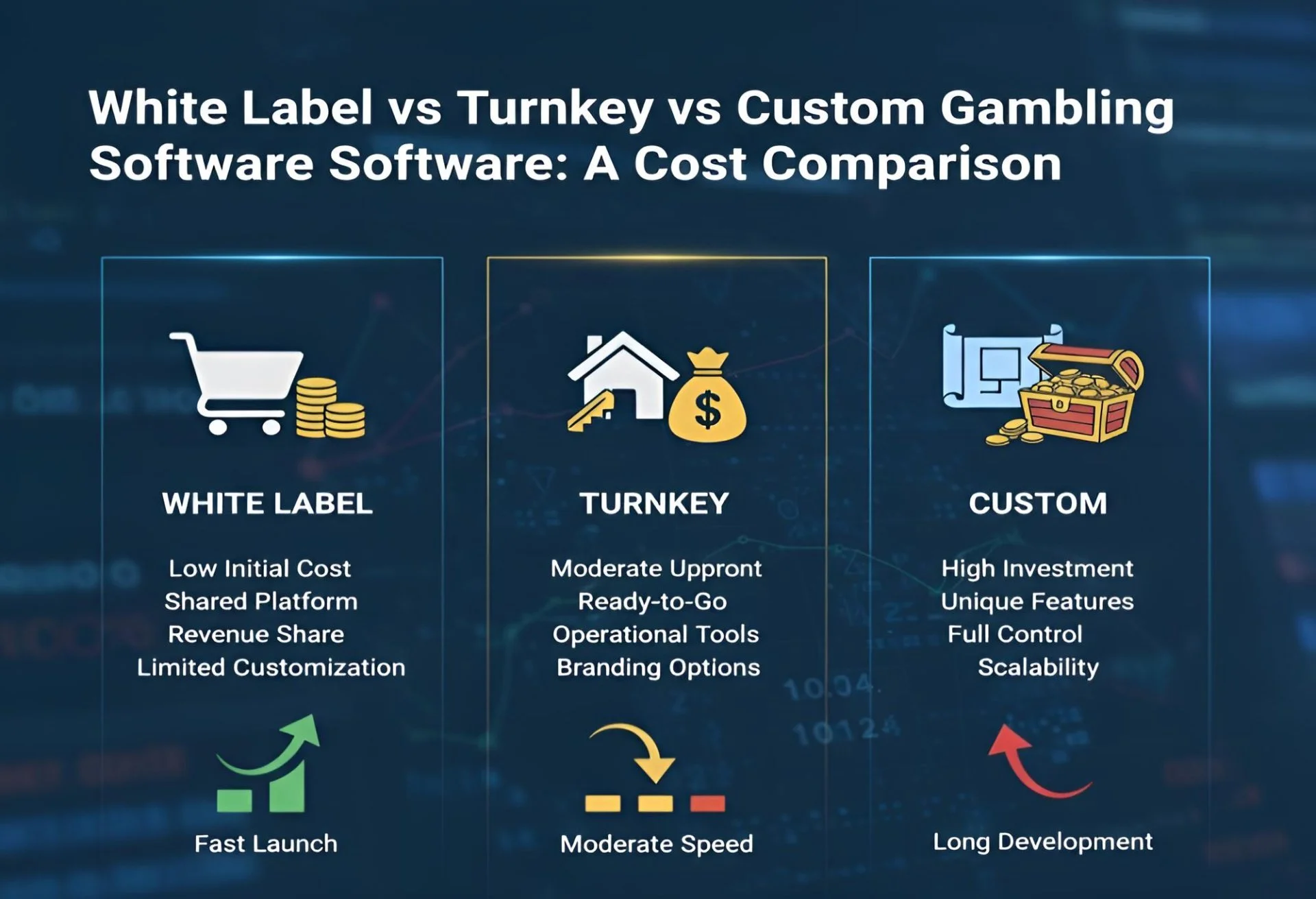

The white label model offers unparalleled speed-to-market and capital efficiency. Compared to building a custom platform, which can cost $500,000 to well over $2 million and take two years to launch, a white label solution is a fraction of the cost and takes as little as 4-12 weeks.

The primary trade-off is control. The operator sacrifices full ownership of the platform and commits to a long-term revenue share. Therefore, the successful white label operator is one who performs a detailed long-term cost analysis, factoring in not just the setup fee, but the aggregate revenue share and the essential, unbundled costs of marketing, staffing, and reserves. For many startups and new entrants, the reduced risk, integrated compliance, and accelerated launch timeline offered by quality White Label Solutions make the revenue-share compromise a highly attractive and profitable proposition. The key is in selecting the right partnership that aligns the provider’s technology costs with the operator’s long-term growth aspirations.