The sports betting industry is a high-stakes arena where fortunes can be won or lost on a single game. For the operators of these platforms, the stakes are even higher. A well-run sportsbook isn’t just a place to take bets; it’s a sophisticated financial enterprise where every decision, from setting odds to accepting a wager, is an exercise in managing risk. Without a robust and proactive approach to risk management, even the most promising online sportsbook can quickly find itself in a precarious position. The foundation of this critical function lies in the quality and capability of the underlying betting software.

A modern sportsbook operator faces a trinity of risks: financial, operational, and reputational. Financial risk is the most obvious—the potential for liabilities to outweigh revenues, leading to significant losses. Operational risk includes everything from platform security breaches and fraud to technical failures. Finally, reputational risk stems from a poor user experience, slow payouts, or being perceived as an unprofessional or unreliable service. A truly great platform, provided by top-tier sports betting software providers, is designed not just to facilitate bets but to act as a powerful engine for mitigating all three of these threats.

The Financial Balancing Act: How Software Manages the Book

The primary goal of a sportsbook is not for a specific team to win or lose, but to balance its liabilities. This is the art of “managing the book,” ensuring that the operator makes a profit regardless of the outcome. In an ideal world, the amount of money wagered on each side of an event would be perfectly balanced, allowing the operator to simply collect the “vig” or commission. However, in reality, money often pours in heavily on one side. This is where the risk management features of the betting software become invaluable.

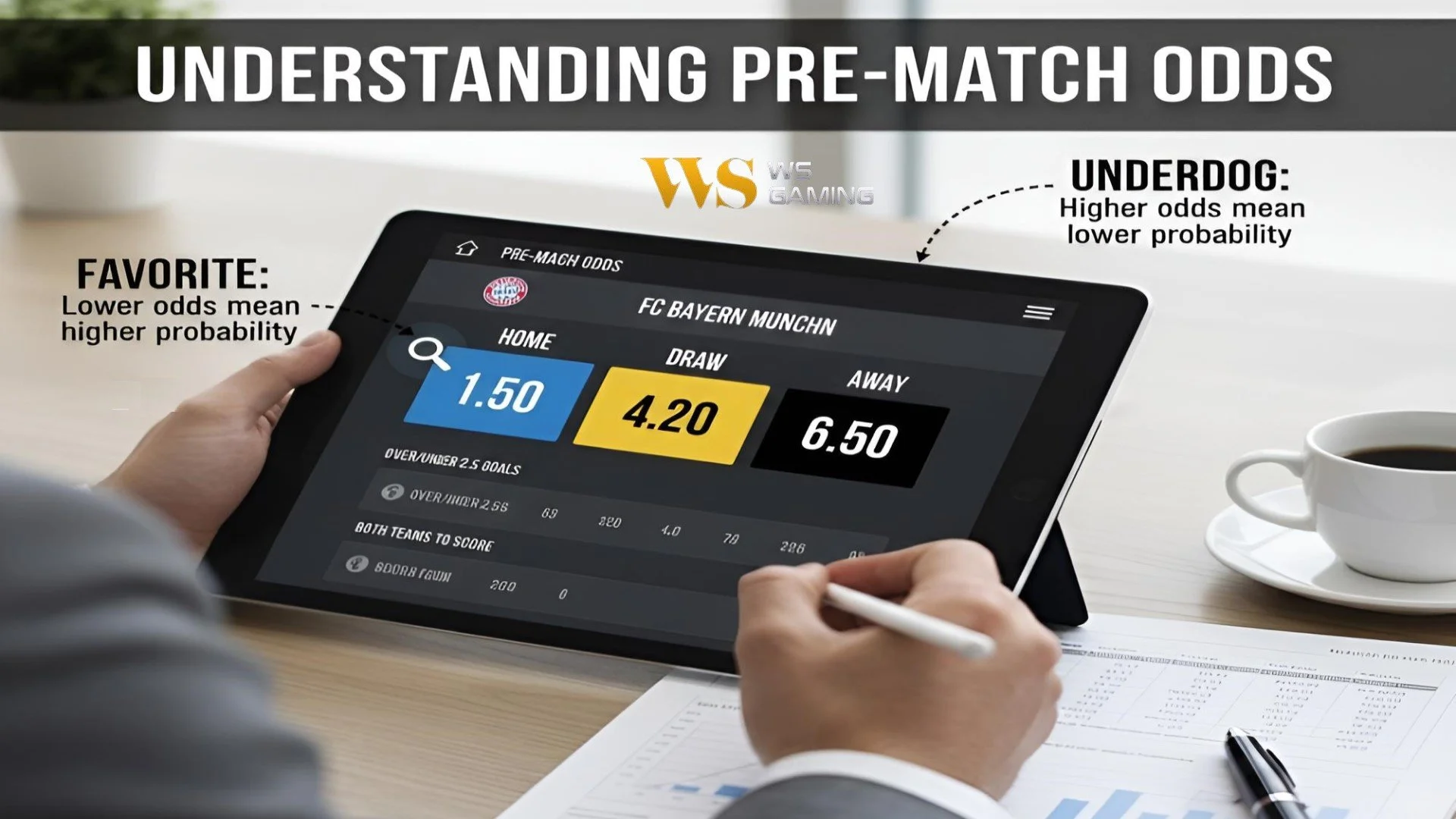

- Dynamic Odds Management: A static odds feed is a recipe for disaster. Professional bettors, known as “sharps,” are constantly looking for stale odds or arbitrage opportunities. Advanced betting software uses sophisticated algorithms to constantly analyze market trends and competitor odds, dynamically adjusting its own odds in real-time. If a large wager is placed on a particular outcome, the software can automatically lower the odds on that outcome and raise them on the other side, encouraging balanced betting and reducing the sportsbook’s exposure.

- Sophisticated Player Profiling: Not all bettors are created equal. The system must be able to distinguish between a casual recreational bettor and a professional who uses analytical models to find value. The software creates a detailed profile for every user, tracking their betting patterns, winning history, and staking habits. This allows the operator to identify “sharp” players and manage their action accordingly, sometimes by setting individual bet limits or delaying bet acceptance to ensure the odds are correct.

- Customizable Betting Limits and Restrictions: No two sporting events carry the same risk. A small, obscure table tennis match is far more vulnerable to a few large bets than a major NFL game. A top-tier betting software platform allows the operator to set granular limits based on a variety of factors: sport, league, event, and even individual player. This gives the operator fine-grained control over their exposure and prevents a single massive wager from causing significant financial damage.

The Operational Fortress: Combating Fraud and Abuse

Beyond financial liabilities, the operational integrity of the platform is paramount. Fraud, bonus abuse, and security breaches can erode profits and destroy a brand’s reputation. This is where the “behind-the-scenes” features of the betting software truly shine.

- Fraud Detection and KYC: The software employs complex algorithms to detect suspicious activity, such as multi-accounting (where one person creates multiple accounts to claim bonuses), bonus abuse, and chargeback fraud. It integrates with Know Your Customer (KYC) systems to verify the identity of every player, creating a secure environment for both the business and its users.

- Payment and Payout Security: A secure payment gateway is non-negotiable. The software must handle thousands of secure transactions per day, protecting sensitive financial data and preventing fraudulent withdrawals. It must also have a robust system for managing payouts, ensuring that withdrawals are processed efficiently and that funds are only released to verified accounts.

- DDoS Protection and System Redundancy: A denial-of-service (DDoS) attack can cripple a website, causing massive financial losses and reputational damage. Top-tier software includes built-in protection against these attacks and is hosted on a highly redundant, scalable infrastructure to ensure 24/7 uptime, a critical factor during major sporting events.

A Case Study in Excellence: The WSGaming Approach

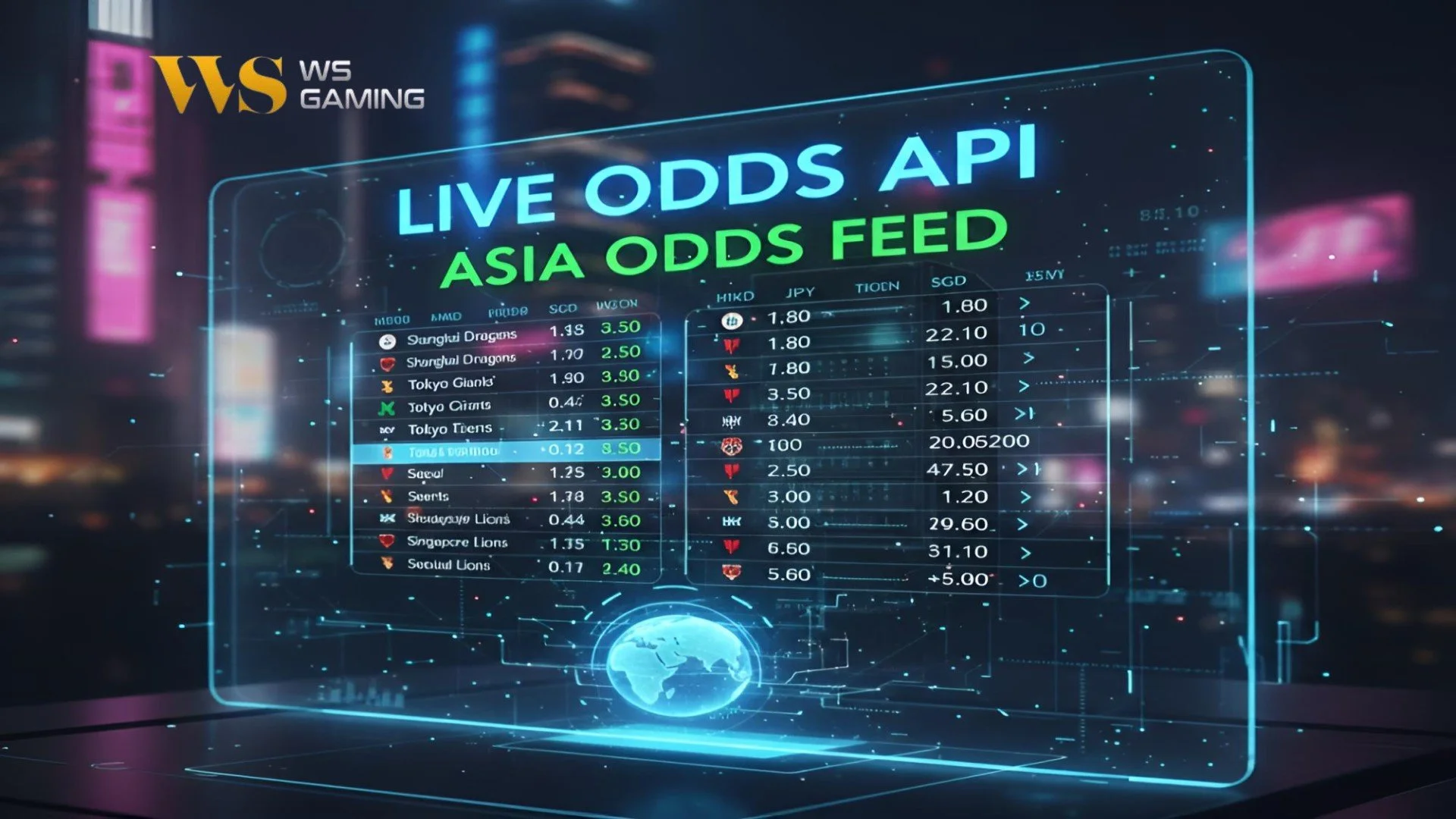

When an operator partners with a specialized firm like WSGaming as a company that provides the software, they are not just acquiring a betting platform; they are leveraging a comprehensive, institutional-grade risk management ecosystem. WSGaming’s philosophy is that risk management is the core of a profitable sportsbook, not an afterthought.

Their platform exemplifies what an operator should look for in a provider. It features an intelligent risk management dashboard that provides a real-time overview of the operator’s exposure on every market. It uses AI-driven algorithms to flag unusual betting patterns and suspicious user behavior, alerting the operator to potential threats before they escalate.

For instance, if a player suddenly places a high-value bet on an obscure match, the WSGaming software will flag this, allowing the operator to review the bet and decide whether to accept it at the current odds, or adjust them. This proactive, data-driven approach allows for precise and informed decision-making. Furthermore, WSGaming’s software comes with a dedicated team of risk management experts who work with operators to fine-tune their strategies and navigate complex betting scenarios, offering a level of support that would be impossible for a startup to develop on its own.

Conclusion: Risk Management as the Path to Profitability

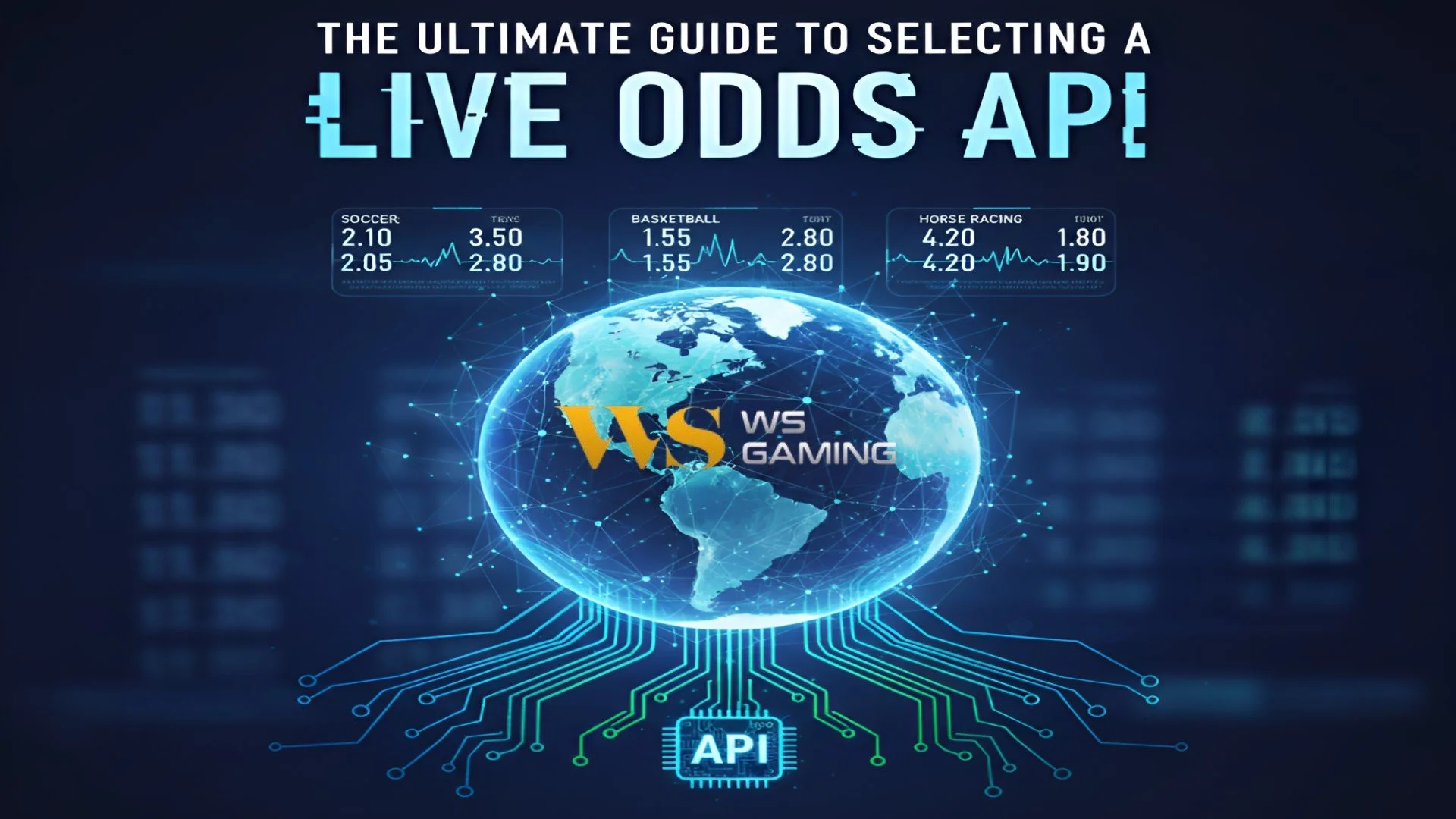

In a competitive market where margins are thin, the difference between a thriving sports betting business and a failed one often comes down to risk management. The notion of simply building a flashy website and a basic odds feed is a remnant of the past. Today’s successful operators understand that a sophisticated betting software solution from leading sports betting software providers is the most critical investment they can make. It is the engine that drives profitability, protects against fraud, and ensures a sustainable, long-term business model. It allows operators to move beyond mere luck and build a truly resilient enterprise, one bet at a time. The partnership with a provider that prioritizes risk management, such as WSGaming, is not just a convenience; it is the cornerstone of a successful iGaming future.

Main FAQ:

For a sportsbook operator, risk management is the process of minimizing potential losses and maximizing profitability by balancing liabilities, detecting fraud, and controlling exposure to betting outcomes.

Modern betting software provides automated tools for dynamic odds management, real-time player analysis, customizable betting limits, and sophisticated fraud detection, all of which are essential for managing a profitable sportsbook.

It is extremely difficult and risky. The complex nature of odds setting, fraud detection, and financial balancing requires sophisticated technology and expert teams that are cost-prohibitive for most startups to build from scratch. Partnering with experienced sports betting software providers is the recommended path.

The biggest risk is financial liability, where a book is heavily unbalanced on a specific outcome, leading to a massive payout that can wipe out profits. Operational risks like fraud and technical downtime also pose significant threats.

Providers like WSGaming offer turnkey solutions with built-in risk management features, including AI-powered dashboards, automated alerts, and dedicated expert support, allowing the operator to focus on their business while the technology handles the complex risk analysis.