The iGaming industry, specifically white label gambling, is experiencing an unprecedented boom, but success hinges on a critical, often-overlooked foundation: the payment system. For white label platforms, which rebrand and deploy a third-party’s core technology, providing a seamless, secure, and compliant payment experience is paramount to building trust, boosting conversion rates, and ensuring regulatory adherence. This comprehensive guide delves into the indispensable strategies for payment gateway integration and the stringent security protocols required to thrive in this high-stakes environment.

The Core Challenge: Integrated Payment Solutions in iGaming

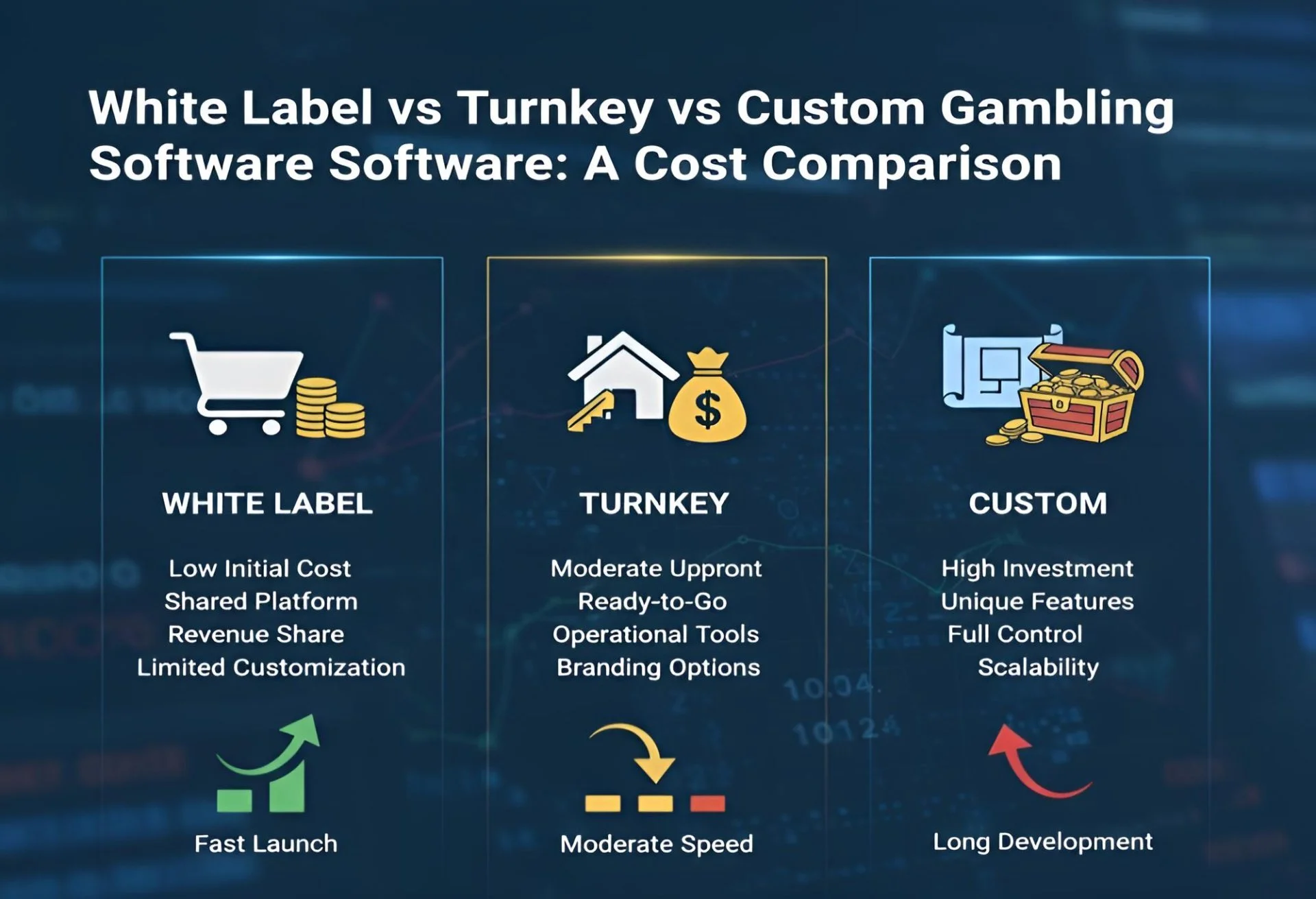

A white label platform WSGaming offers a fast, cost-effective entry into the market. However, the ‘plug-and-play’ model can mask the complexities of financial operations. Unlike traditional e-commerce, iGaming platforms—from online casinos to sportsbooks—handle large transaction volumes, high average transaction values, and a global player base, all while being classified as high-risk by financial institutions.

The primary challenge lies in integrating a versatile, global payment solution without exposing the platform or its users to undue risk. An effective payment gateway must be more than just a checkout form; it must be a multi-layered financial infrastructure that handles payment processing, currency conversion, regulatory compliance, and robust fraud mitigation—all under the operator’s brand.

The Role of an Integrated Payment Solutions Provider

An integrated provider for a white label system acts as the technical bridge between the platform’s front-end and the global financial network (banks, card schemes, e-wallets, and crypto exchanges). Their solution is built on four pillars:

- Global Connectivity: Access to a wide array of payment methods popular in target markets, including local banking options, international cards (Visa, Mastercard), and digital wallets (Skrill, Neteller).

- Branding: The ability to fully customize the payment pages to maintain a cohesive brand experience, reinforcing user trust.

- Compliance Management: Handling complex regulatory requirements like PCI DSS (Payment Card Industry Data Security Standard) and money laundering prevention.

- Risk Mitigation: Deploying advanced systems for Fraud Protection and managing chargebacks, which are notoriously high in the iGaming sector.

Essential Integration Strategies for White Label Platforms

Successful payment integration on a white label platform is a strategic process that involves choosing the right technical model and ensuring development standards are met.

1. Choosing the Right Integration Model

White label platforms typically leverage two main integration types, both provided by the gateway partner:

- API Integration (Direct Post): This method offers the highest level of customization and control. The payment data is collected directly on the white label’s server, then encrypted and sent to the gateway via a secure API. This seamless experience is excellent for conversion but places a heavy burden of responsibility on the operator, primarily for maintaining strict PCI DSS compliance.

- Hosted Payment Page (HPP): The user is redirected to a page hosted by the payment gateway provider to enter their sensitive details. The key advantage is that the compliance burden shifts almost entirely to the provider, making it the preferred, lower-risk choice for many white label operators. Modern HPPs can be styled to look completely integrated, minimizing user confusion.

2. Multi-Currency and Localization

For a global platform, multi-currency support is non-negotiable. The integrated solution must facilitate:

- Acceptance: Processing transactions in a multitude of local currencies.

- Conversion: Offering transparent exchange rates and managing the risk of FX fluctuations.

- Settlement: Settling funds with the operator in their preferred base currency.

Localizing payment methods is equally vital. A platform targeting the European market must support SEPA transfers, while one focused on Brazil needs to offer Pix. A robust White Label Gambling Payments provider aggregates these localized options through a single, unified API.

3. Cryptocurrency Integration: The Future of iGaming

The integration of Crypto Casino Software has moved from a niche feature to a market necessity. Cryptocurrencies offer lower transaction fees, faster processing times (particularly for withdrawals), and enhanced privacy for players—all significant advantages in gambling.

A white label platform needs a gateway that can:

- Handle Multi-Asset Wallets: Support a variety of major and altcoins (BTC, ETH, LTC, USDT, etc.).

- Instant Conversion: Convert crypto deposits to a fiat operating currency (or vice versa for payouts) instantaneously to mitigate volatility risk.

- Compliance Bridge: The provider must ensure all crypto-to-fiat transactions are recorded and compliant with evolving AML regulations.

Fortifying Security and Compliance

The high-risk nature of iGaming mandates a gold standard for security. Failure to protect player data and prevent financial crime can result in massive fines, license revocation, and permanent brand damage.

1. Data Security: PCI DSS and Tokenization

While white label systems reduce the operator’s direct security responsibility, the platform must still adhere to best practices:

- PCI DSS Compliance: Any part of the platform that touches card data, even momentarily, must comply. Choosing a payment partner that is Level 1 PCI DSS certified is the foundation.

- Tokenization: This security measure replaces a player’s sensitive payment data (like a 16-digit card number) with a unique, non-sensitive string called a “token.” The operator stores only the token, making the actual card data useless to hackers and significantly lowering the platform’s PCI compliance scope.

2. Anti-Money Laundering (AML) and Know Your Customer (KYC)

Gambling platforms are a prime target for money laundering. An integrated solution must incorporate mandatory AML/KYC Tools to verify player identity and track transaction patterns.

- KYC (Know Your Customer): This process verifies the identity of a customer, typically required before large payouts or after certain deposit thresholds are met. White label providers often integrate digital identity verification services that can validate government IDs and proofs of address in real-time.

- AML (Anti-Money Laundering): The payment gateway must monitor transactions for suspicious activity—such as rapid, high-volume deposits and withdrawals, or transactions from high-risk geopolitical areas—and flag them for manual review.

3. Fraud Protection and Chargeback Mitigation

Chargebacks—when a cardholder disputes a transaction with their bank—are a major cost center in iGaming. Robust Fraud Protection strategies are essential to minimize this loss:

- 3D Secure: Implementing the latest version of 3D Secure (e.g., 3D Secure 2.0) adds a layer of authentication (like a one-time password) to card transactions, shifting the liability for fraudulent chargebacks from the merchant to the card issuer.

- Velocity Checks and Geolocation: Automated systems must perform real-time checks on transaction frequency, value, and the geographical location of the payer versus the registered account.

- Machine Learning/AI: The most advanced payment gateways use AI to analyze millions of data points to create dynamic risk scores for every transaction, identifying subtle patterns indicative of fraud that human analysts would miss.

Frequently Asked Questions (FAQ)

The biggest financial risk is chargebacks due to fraud. The high-risk nature of the industry means a high volume of chargebacks can lead to excessive fees, freezing of merchant accounts, or even blacklisting by card networks like Visa and Mastercard. Robust Fraud Protection is the primary defense.

Not necessarily, but it depends on the integration model. By utilizing a Hosted Payment Page (HPP), a Level 1 certified gateway provider takes on the bulk of the PCI DSS compliance burden. However, if the platform uses a direct API Integration where any card data touches the operator’s server, the operator assumes a higher level of compliance responsibility.

AML/KYC Tools are essential for Anti-Money Laundering and Know Your Customer compliance. They verify the identity of players and monitor their transactions for suspicious patterns. This is crucial because gambling platforms are legally obligated to prevent the flow of illicit funds, making these tools a non-negotiable part of secure White Label Gambling Payments.

Integrating Crypto Casino Software adds a layer of complexity. The payment gateway must provide a “compliance bridge,” meaning it must record and monitor all crypto-to-fiat conversions and ensure the source and destination of funds meet regulatory standards to stay compliant with AML guidelines.

Tokenization is the process of replacing sensitive payment data (like card numbers) with a non-sensitive surrogate value (a “token”). It is critical for an Integrated Payment Solutions provider as it secures recurring payments, reduces the platform’s PCI DSS scope, and drastically lowers the risk of a catastrophic data breach.

A white label operator must partner with a tier-one Integrated Payment Solutions provider that has a vast network of local acquiring banks and financial institutions. These providers aggregate local payment methods (e.g., Brazilian Pix, European SEPA, Asian e-wallets) into a single API, allowing the platform to cater to different regional player preferences efficiently.

Velocity checks are Fraud Protection tools that monitor the speed and frequency of transactions (e.g., too many transactions in a short time frame from one card). Geolocation checks compare the physical location of the IP address making the payment with the player’s registered country, flagging discrepancies that suggest the use of a VPN or a compromised account.

The greatest advantage is speed and complexity reduction. The platform can begin processing White Label Gambling Payments almost immediately under the provider’s existing licenses and compliant frameworks, sidestepping the months or years required and the immense cost of obtaining and maintaining a full, independent gambling license and all associated payment regulatory approvals.

Beyond mandatory compliance, robust AML/KYC Tools contribute to financial sustainability by reducing long-term fraud and chargeback costs. By accurately verifying a customer’s identity upfront, the platform weeds out fraudulent actors and money launderers, protecting its reputation and reducing the financial penalties and operational overhead associated with financial crime.

The key features are instant fiat conversion, robust wallet management, and regulatory transparency. The ideal gateway for Crypto Casino Software must instantly convert crypto deposits to a stable fiat currency to mitigate volatility and provide auditable transaction trails necessary to satisfy traditional financial regulators.