In the high-stakes world of modern betting and trading, the difference between marginal gains and maximum profitability often comes down to one critical factor: the speed and sharpness of your data. The days of relying on static odds or gut instinct are over. Today, success is inextricably linked to the ability to leverage real-time odds—precise, constantly updating price points that reflect every shift in market dynamics, player performance, and financial liability. This is the new frontier of risk management and revenue generation, where technology transforms uncertainty into a calculated advantage.

The shift toward data-centric operations is driven by an increasingly sophisticated and competitive landscape. Whether you are a sportsbook managing your risk exposure or a professional bettor seeking an edge, the foundation of your strategy must be built upon access to and intelligent analysis of the best available information. This is where the power of sharp odds data comes into play, providing the clarity needed to make split-second, value-driven decisions.

The Core Pillars of Profit Maximization

Achieving maximum profitability requires a multi-faceted approach, with each pillar supported by superior data quality and speed:

1. Instantaneous Market Reflection: The Power of Real-Time Odds

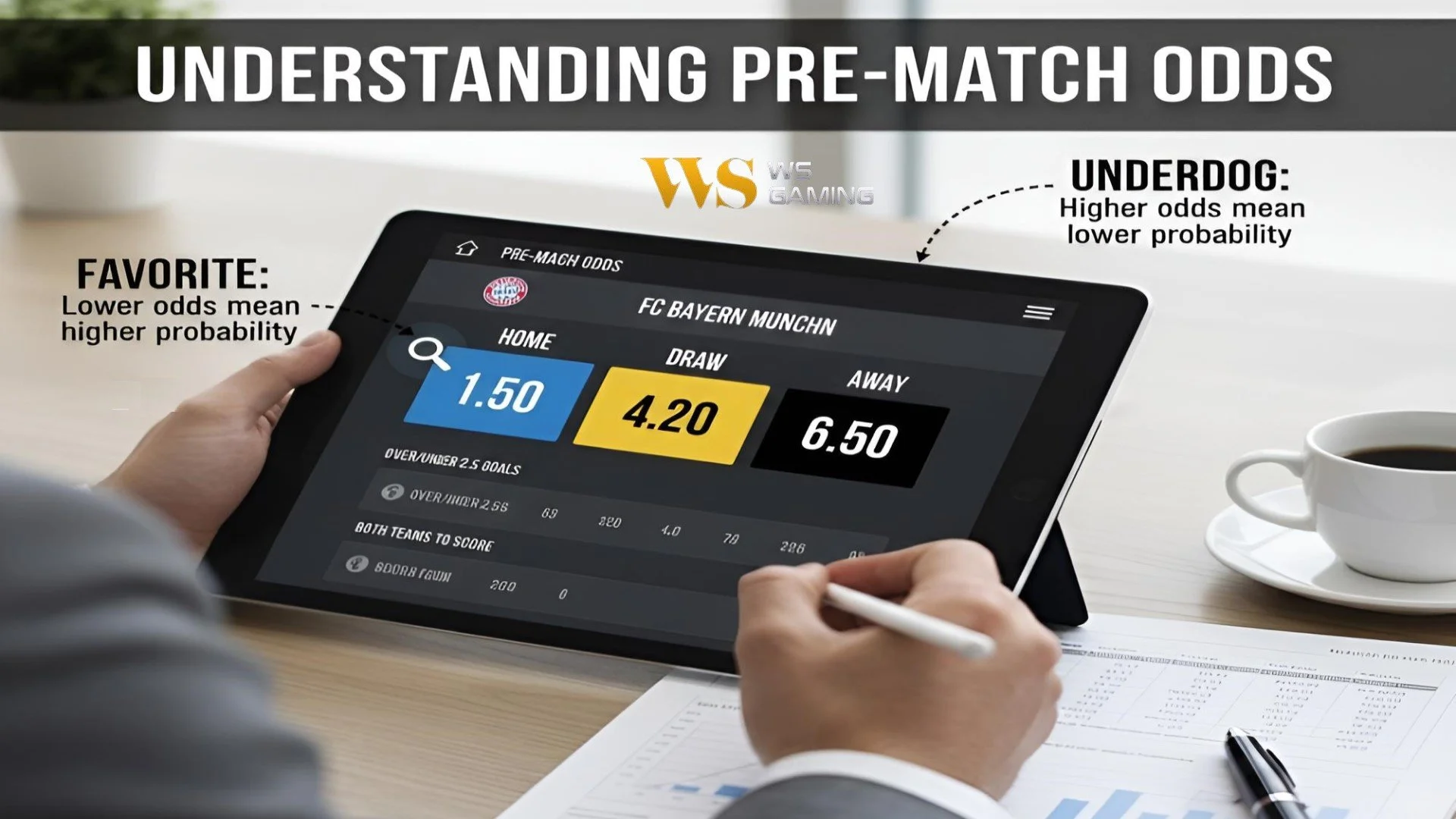

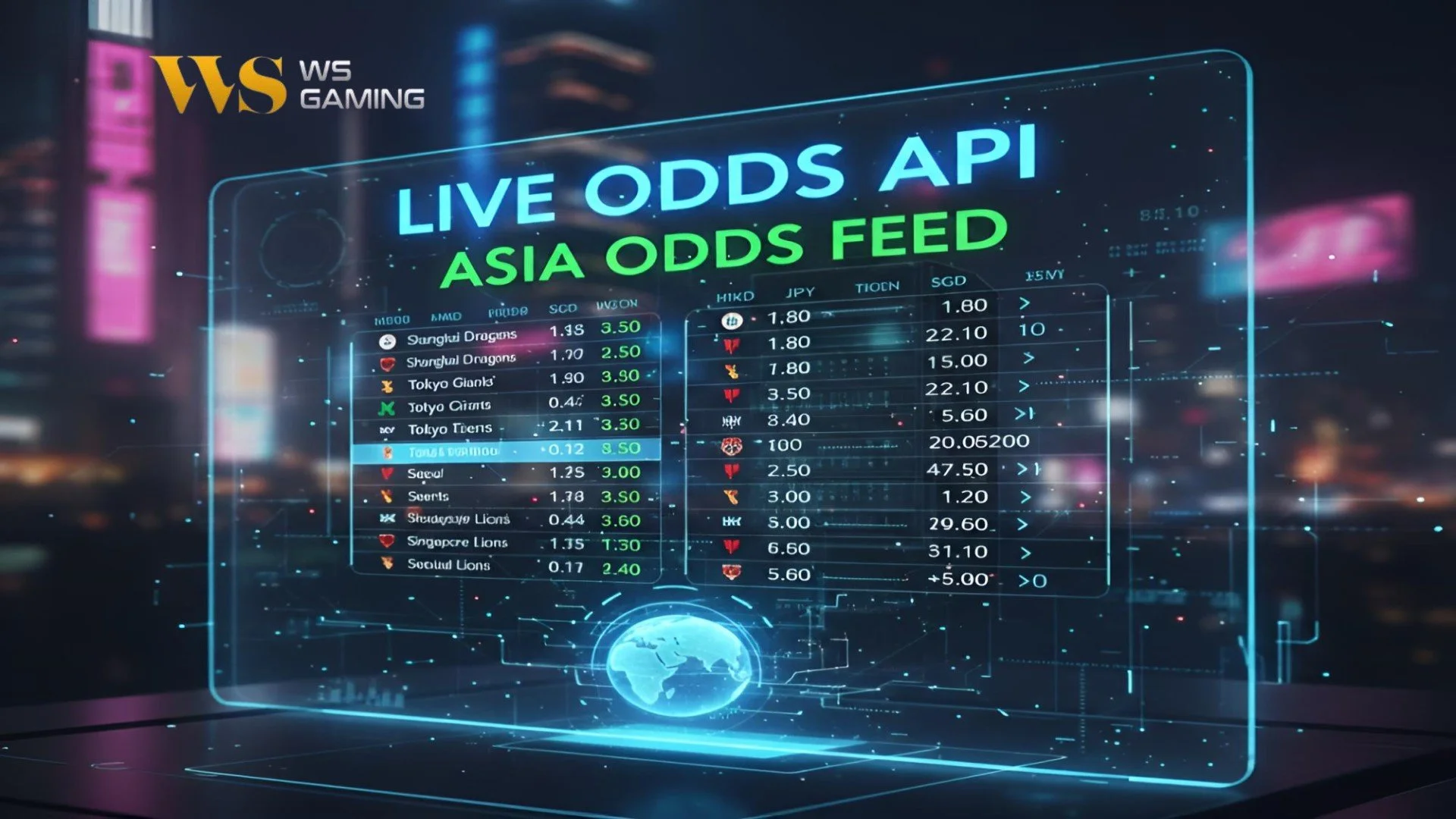

The core component of a modern betting system is its ability to deliver real-time odds. In-play betting, which now accounts for a significant portion of the global betting volume, demands latency measured in milliseconds, not seconds. A sportsbook that can update its lines faster than its competitors minimizes its exposure to “stale” odds that savvy bettors can exploit.

For the bettor, comparing real-time odds across multiple operators is the essence of line shopping—a fundamental strategy to ensure they always get the best available price. Even a marginal difference in odds, when compounded over thousands of wagers, drastically alters the expected value (EV) and overall return on investment (ROI). In essence, speed equals value; the faster you have the true price, the more efficiently you can allocate your capital for maximum profitability.

2. AI-Driven Prediction and Risk Mitigation

The complexity of modern sporting events—with countless variables including player fatigue, weather, historical head-to-head performance, and in-game momentum—has outpaced human capacity for manual risk calculation. This has fueled the necessity of AI-driven odds.

Advanced machine learning models analyze colossal datasets to generate highly predictive, probability-based odds. These AI-driven odds serve as the “true” market price, allowing operators to set their lines with surgical precision and providing a benchmark for sharp bettors looking for market inefficiencies. The AI not only sets the initial, most accurate lines but also powers smarter odds management by automating risk adjustments in real-time. For a bookmaker, this means protecting against large, unexpected liabilities. For a bettor, it means identifying where a “soft” book is lagging behind the consensus set by the AI-powered market-makers.

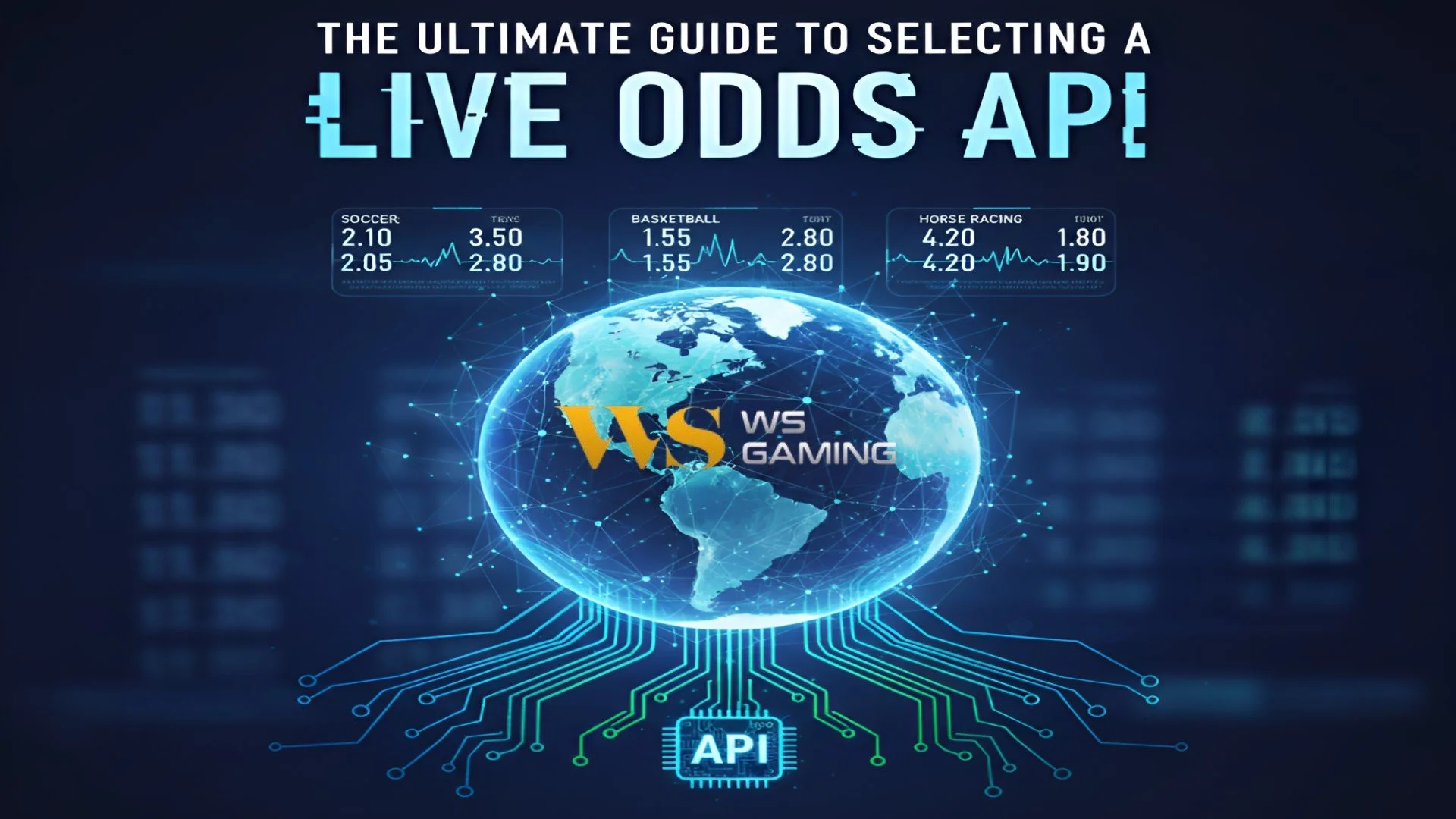

3. Strategic Pricing and Market Leadership

In a crowded market, simply having accurate odds is not enough; they must also be competitive. Competitive pricing involves balancing the need for a healthy house margin (or “vig”) with the necessity of attracting and retaining high-volume customers. A platform with superior sharp odds data can afford to offer tighter margins—meaning better odds for the customer—because its confidence in the underlying true probability is higher.

This is a powerful competitive loop: smarter odds management allows for competitive pricing, which attracts more liquidity (more bets), and this increased activity further refines the AI-driven odds, making the overall system more robust and profitable. This strategic approach elevates an operator from a follower to a market leader.

4. Smarter Odds Management: Beyond Static Lines

The real genius of maximizing profit lies in smarter odds management. This is the operational discipline that turns data into dollars. It encompasses automated systems for managing bet liability, setting dynamic limits for different customer profiles (distinguishing between “sharp” and “square” money), and rapidly adjusting overrounds across a full portfolio of betting markets.

Crucially, smarter odds management uses sharp odds data to anticipate where lines are going to move, not just where they are. By predicting line convergence, a proactive system can adjust its positions to take advantage of the expected change, rather than reacting to it after the fact. This strategic agility is the hallmark of a system designed for maximum profitability.